Latest News

ATO Support For Businesses In Difficult Times

The ATO has reminded taxpayers that it has a range of support available for small businesses experiencing difficult situations, such as natural disasters, mental health challenges or financial hardship. Depending on the business taxpayer’s circumstances, the ATO may be able to: give the business extra time to pay its tax. set up a payment plan […]

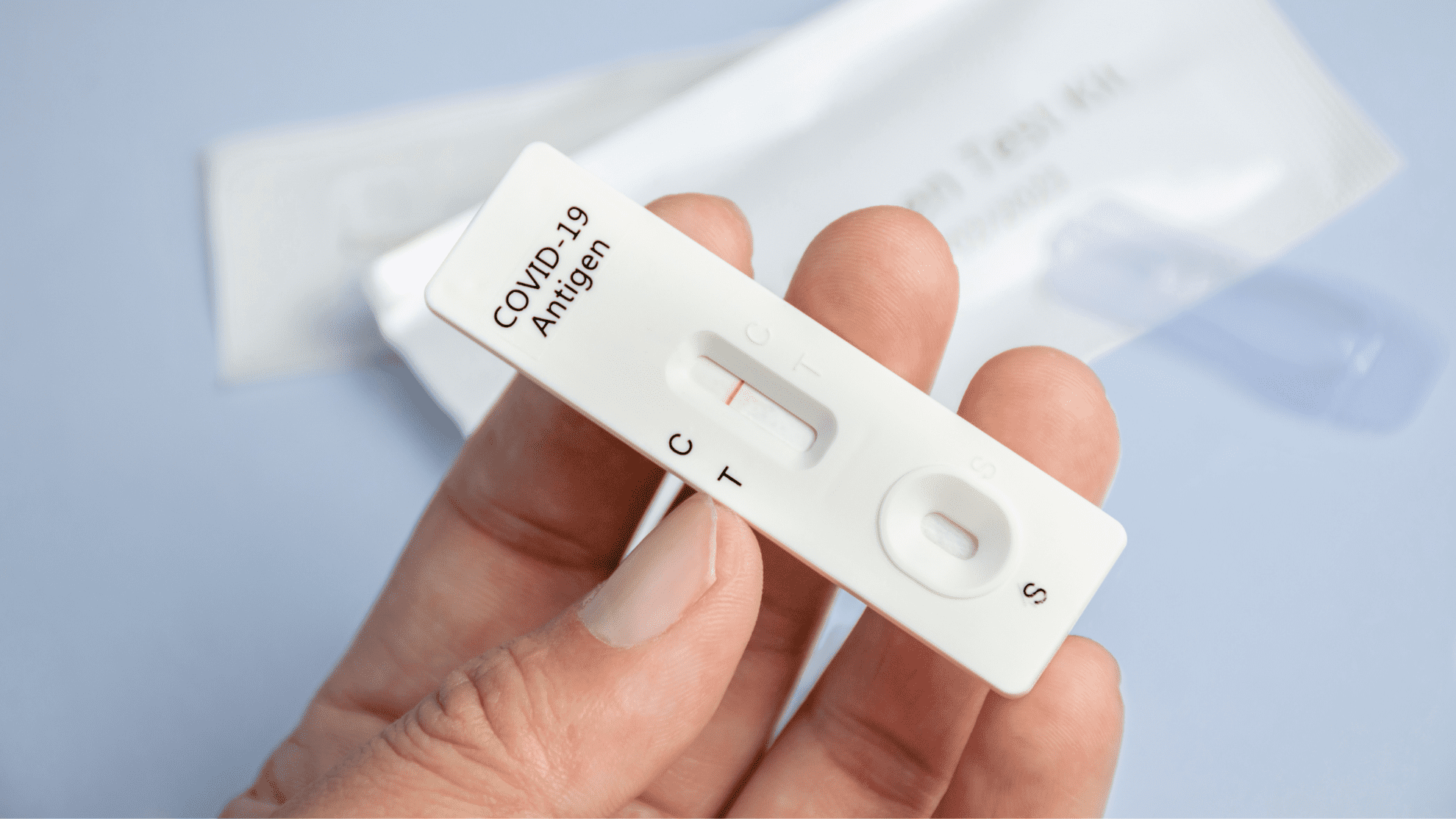

Covid Test Costs To Be Tax Deductible

The Australian government announced on 7 February 2022 that legislation will be changed to ensure covid test costs will be tax deductible for the 2022 financial year. The deduction will apply both when an individual is required to attend the workplace or has the option to work remotely. What testing expenses will you be able […]

Payment Extension Relating To Jobkeeper Objections

The JobKeeper rules have been amended to ensure the ATO can make payments to certain taxpayers after 31 March 2022. Where a taxpayer has objected to an ATO decision relating to JobKeeper, a payment can be made by the ATO after 31 March 2022 to give effect to the objection decision and decisions of the […]

Single Touch Payroll Exemption Extended For WPN Holders

The ATO has extended the Single Touch Payroll (‘STP’) reporting exemption available to entities that have a withholding payer number (‘WPN’). As a result of this extension, certain entities that have a WPN (but not an ABN) will not be required to report under STP for the 2021‑22 and 2022-23 financial years. This continues the […]

Higher PAYG Withholding Rates Continue to Apply To Backpackers

As we recently communicated, the High Court has held that the ‘working holiday maker tax’ (also known as the ‘backpackers’ tax’) did not apply to a taxpayer on a working holiday visa from the United Kingdom who was also an Australian tax resident. This was due to the application of the Double Tax Agreement between […]

COVID-19 Vaccination Incentives And Rewards

The ATO has reminded employers to consider their tax and super obligations when employees are provided with incentives or rewards for getting their COVID-19 vaccination. When employees are provided a cash payment, including paid leave for employees to get their COVID-19 vaccination (or additional paid leave to recover from any vaccination side effects), employers should […]

Sign up to our fortnightly newsletter for all latest tax updates

What’s New For Taxpayers

Before you complete your tax return for 2015, there are some changes you should be aware of in case they affect you. Mature age worker tax offset You can no longer claim the Mature age worker tax offset (MAWTO) in your tax return. Previously, to be eligible for the offset you needed to be an […]

Travel between home and work and between workplaces

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, you can only claim for the part related to your work. What you can claim You can […]

Investment Property – Claiming Repairs and Maintenance Expenses

Can you claim the cost of repairs you make before you rent out the property? You cannot claim the cost of repairing defects, damage or deterioration that existed when you obtained the property, even if you carried out these repairs to make the property suitable for renting. This is because these expenses relate to the […]

Gifts and donations

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). Deductions for gifts are claimed by the person that makes the gift (the donor). For you to claim a tax deduction for a gift, it must meet four conditions: The gift […]

Capital gains tax checklist

The following questions will help you to identify possible capital gains tax (CGT) obligations. If you answer ‘yes’ to any of these questions, CGT may apply. Some questions are intended to highlight the possibility of a capital gain or loss arising in the current year, others to alert you to the possibility of a […]

Tax on Super Contributions

The tax you pay on your super contributions generally depends on whether the contributions were made before or after you paid income tax, you exceed the super contributions cap or you are a very high-income earner. Before-tax super contributions The super contributions you make before tax (concessional) are taxed at 15%. Types of before-tax contributions […]