Latest News

ATO reminder about family trust elections

Taxpayers may be considering whether they should make a family trust election (‘FTE’) for a trust, or an interposed entity election (‘IEE’) for a trust or other entity. Making an FTE provides access to certain tax concessions (assuming the relevant tests and conditions are satisfied), although there are important things to consider. In particular, once […]

Taxpayer’s claims for various ‘home business’ expenses rejected

In a recent decision, the AAT rejected in full a taxpayer’s claims for “several classes or categories of deductions.” For the relevant period of 1 July 2021 to 30 June 2022, the taxpayer was (according to his employer) a ‘technical architect’. However, the taxpayer also claimed he worked from home 6am to 11pm seven days […]

SMSFs cannot be used for Christmas presents!

There are very limited circumstances where taxpayers can legally access their super early, and the ATO is reminding taxpayers that “paying bills and buying Christmas presents doesn’t make the list.” Generally, taxayers can only access their super when they: reach preservation age and ‘retire’; or turn 65 (even if they are still working). To access […]

ATO’s tips for small businesses to ‘get it right’

While the ATO knows most small businesses try to report correctly, it understands that mistakes can happen. The ATO advises taxpayers that it is important to get the following ‘basics’ right: using digital tools and business software to help track and streamline processes to increase the efficiency of their business; keeping accurate and complete records, […]

Reminder of December 2024 Quarter Superannuation Guarantee (‘SG’)

Employers are reminded that employee superannuation contributions for the quarter ending 31 December 2024 must be received by the relevant super funds by 28 January 2025. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest […]

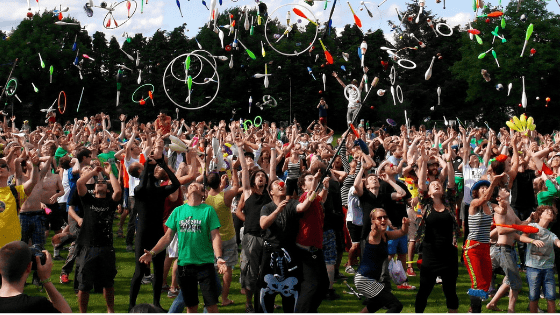

Can staff celebrations attract FBT?

With the holiday season coming up, employers may be planning to celebrate with their employees. Before they hire a restaurant or book an event, employers should make sure to work out if the benefits they provide their employees are considered entertainment-related, and therefore subject to fringe benefits tax (‘FBT’). This will depend on: the amount […]

Sign up to our fortnightly newsletter for all latest tax updates

Very pleasant and helpful

From the outset, of phoning to make an appointment to get our returns completed, I spoke to a very pleasant and helpful lady. She was able to confirm an appointment convenient to us all without too much of a time delay to get to see our agent. Client name withheld – Malaga

Crowdfunding and Taxes

Not so many years ago, the concept of raising funds via crowdfunding would more likely be seen as a way to fund community-based, local-issue or help-your-neighbour initiatives. But increasingly these days crowdfunding is viewed as a viable source of seed capital and is no longer regarded as the shy little sister of venture capitalism. So […]

Get a Clear View With a Private Tax Ruling

There have been cases where people believe the idle talk about being able to coerce a better tax outcome simply by applying for a private ruling from the ATO. But there are some sober facts that you may need to keep in mind if you have thought of it yourself. Any taxpayer can apply for […]

Changing Details in Your Tax Return After It’s Lodged

Say for example that we have already lodged your 2017-18 tax return and forwarded your notice of assessment to you saying that everything is as discussed, but you then realise that something has been left out of your return, or you accidentally included an extra deduction or doubled one up. You ask yourself – Can […]

Personal Services Income: An Overview

It is not uncommon for professional people who provide services to set up a separate entity to run their business, be it a trust, partnership or incorporated company. The allure of course is the lower tax rate that these can secure, rather than at the top marginal tax rate that an individual would generally wear. […]

How Much Do You Need To Retire

The question “How much do you need to retire?” requires an individual answer. Each one of us lucky enough to reach the brink of those golden years will feel a lot better doing so with some assurance that we’ve squirreled enough away to be comfortable in retirement. The answer to the above question is made all […]