Latest News

New ATO Data-Matching Programs

The ATO acquires and uses data for pre-filling, detecting dishonest or fraudulent behaviour, and identifying areas where it can educate taxpayers to help them understand their tax obligations. When data does not match, the ATO may contact tax agents and their clients to find out why. Rental Income Data-Matching Over the coming months, the ATO […]

ATO’s focus on small business

The ATO is ‘detecting and addressing’ recurring errors in specific industries when businesses have a turnover between $1 million and $10 million. These industries include property and construction (including builders, contractors and tradies), and professional, scientific and technical services (including engineering, design, IT and consulting professionals). In these industries, the ATO continues to see recurring […]

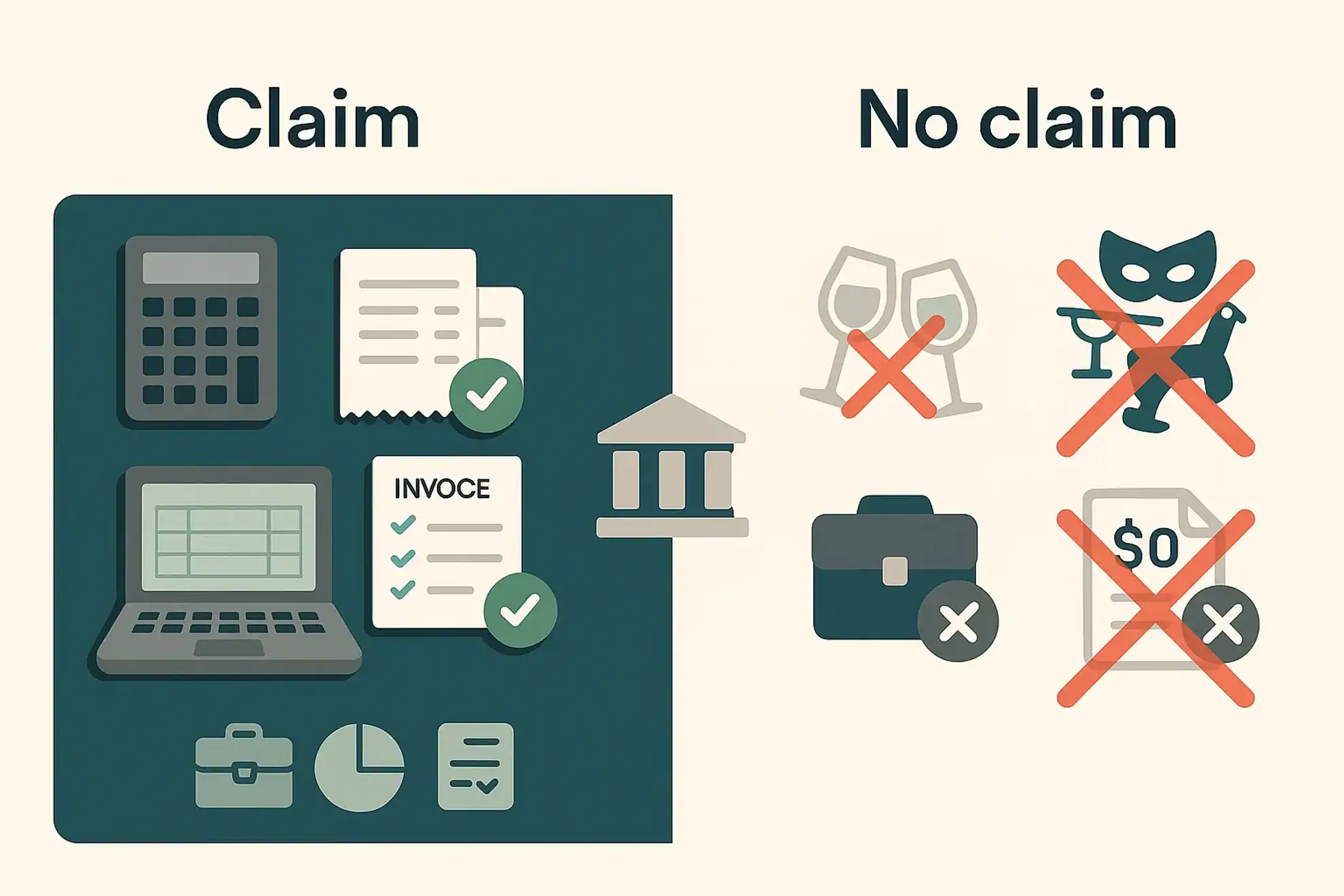

ATO reminder: Business expenses that can (and cannot) be claimed

Taxpayers can claim a tax deduction for most business expenses, provided they meet the ATO’s three ‘golden rules’: The expense must be for business use, not for private use. If the expense is for a mix of business and private use, they can only claim the portion that is used for business. They must have […]

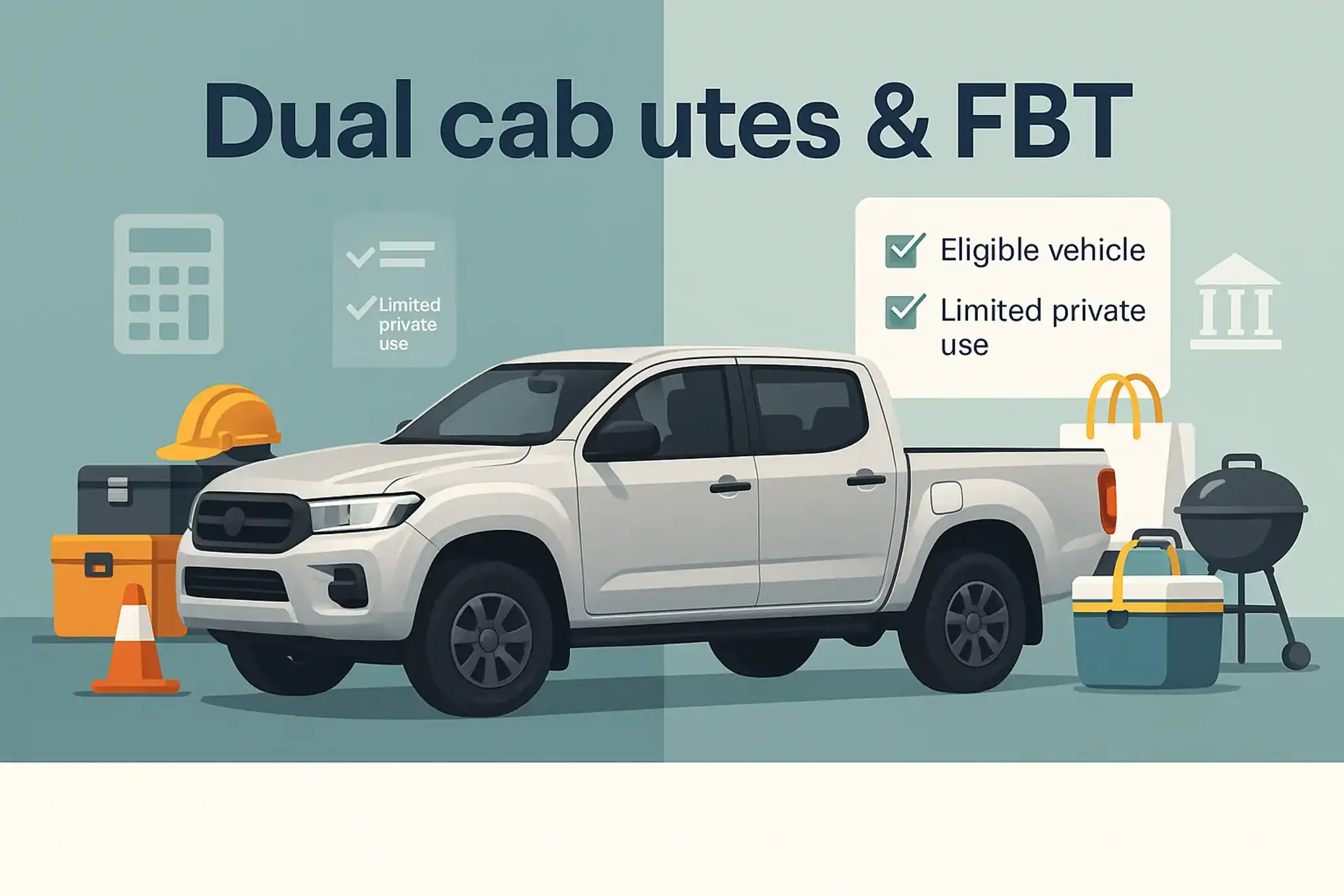

Dual cab utes and FBT

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT. By understanding how their employees use […]

ART dismisses argument that medical expenses were deductible

In a recent decision, the Administrative Review Tribunal (‘ART’) held that a taxpayer could not claim a tax deduction for medical expenses incurred by him in relation to his total and permanent disability pension. The taxpayer had been terminated from his employment due to total and permanent disablement (‘TPD’). For the 2024 income year, his […]

ATO warning regarding private use of work vehicles and FBT

Employers that supply work vehicles to their employees need to check how the work vehicles are used and whether any exemptions apply to determine if they attract fringe benefits tax (‘FBT’). FBT generally applies when a work vehicle is made available for private use, even if it is not actually used. Private use includes any […]

Get Ready For Super Changes From 1 July 2022

As the new financial year approaches, employers need to be aware of two important super changes. From 1 July 2022, employees can be eligible for super guarantee (‘SG’), regardless of how much they earn, because the $450 per month eligibility threshold for when SG is paid has been removed. Employers only need to pay super […]

ATO To Start Clearing Backlog Of ENCC Release Authorities

Due to “unavoidable delays caused by improvements to” its systems, the ATO will start issuing requests to release excess contributions and other charges for individuals who did not make an election on the tax treatment of their excess non-concessional contributions (‘ENCC’) for prior financial years. This may result in a higher than normal number of […]

ATO Warns About GST Fraud

Taxpayers are being warned to be on the lookout for dodgy online ads, often on social media platforms, promising easy GST refunds. The ATO recently issued a media release about large-scale GST fraud attempts exceeding $850 million, that involve customers setting up an ABN without operating a business, and then submitting fictitious BAS statements to […]

Employers Need To Prepare For Changes Under Single Touch Payroll Phase 2 Expansion

Single Touch Payroll (‘STP’) reporting has been expanded. This expansion, known as ‘STP Phase 2’, means that employers will need to start reporting extra information to the ATO each time they run their payroll. Some digital service providers (‘DSPs’) needed more time to update their products and applied for deferrals, which cover their customers – […]

High Court Rejects Attempt To Disclaim Interest In Trust Distribution

The High Court has rejected a taxpayer’s attempt to disclaim an interest in trust income that arose as a result of a default beneficiary clause being triggered. Facts The taxpayer, Ms Natalie Carter, was one of five default beneficiaries of the Whitby Trust, a discretionary trust. For the 2014 income year the trustee had failed […]

Disclosure Of Business Tax Debts

The ATO is in the process of writing to taxpayers that may be eligible to have their tax debts disclosed to credit reporting bureaus (‘CRBs’). The ATO can potentially report outstanding tax debts to a CRB where the following criteria are satisfied: The taxpayer has an Australian business number and is not an excluded entity; […]