Latest News

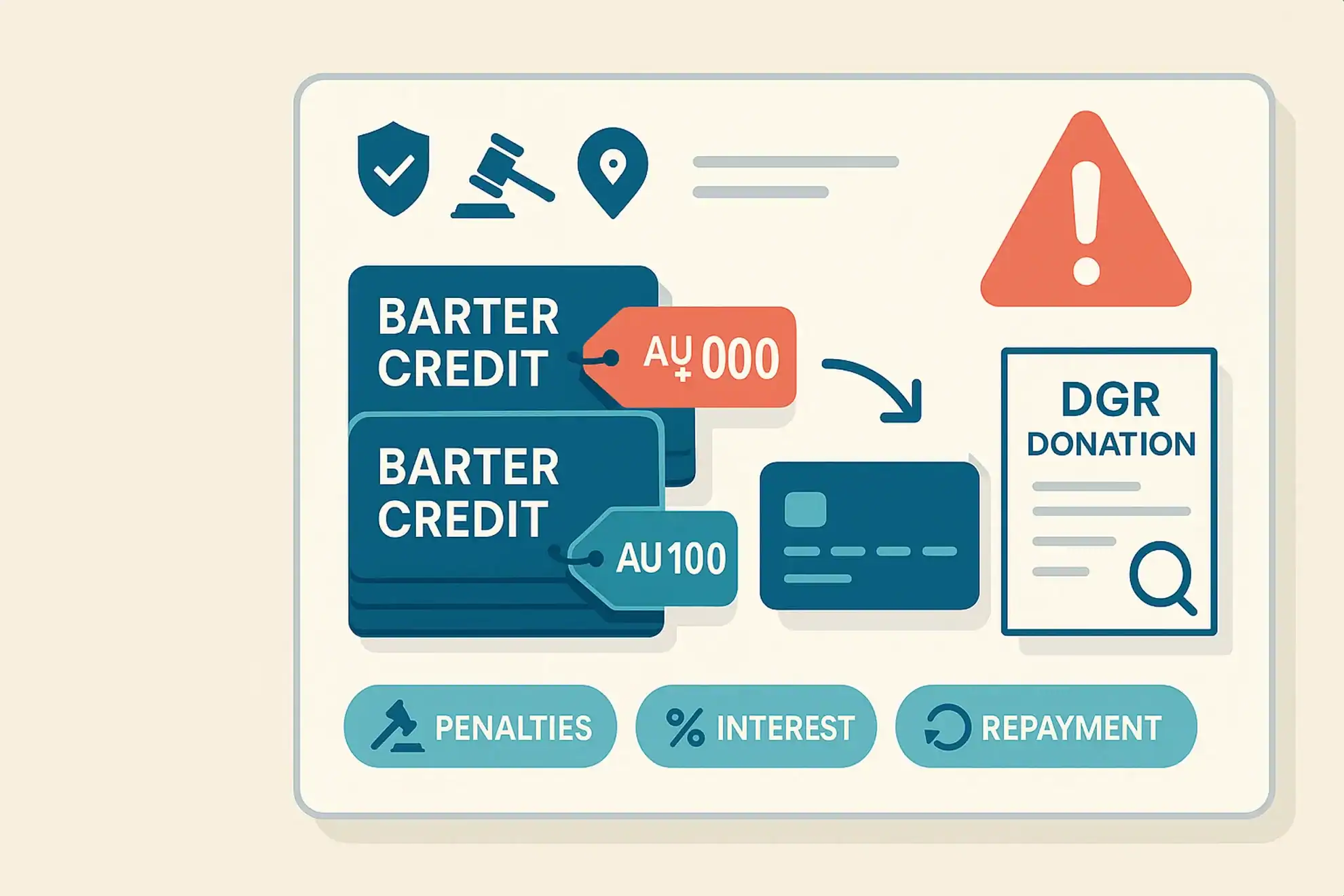

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

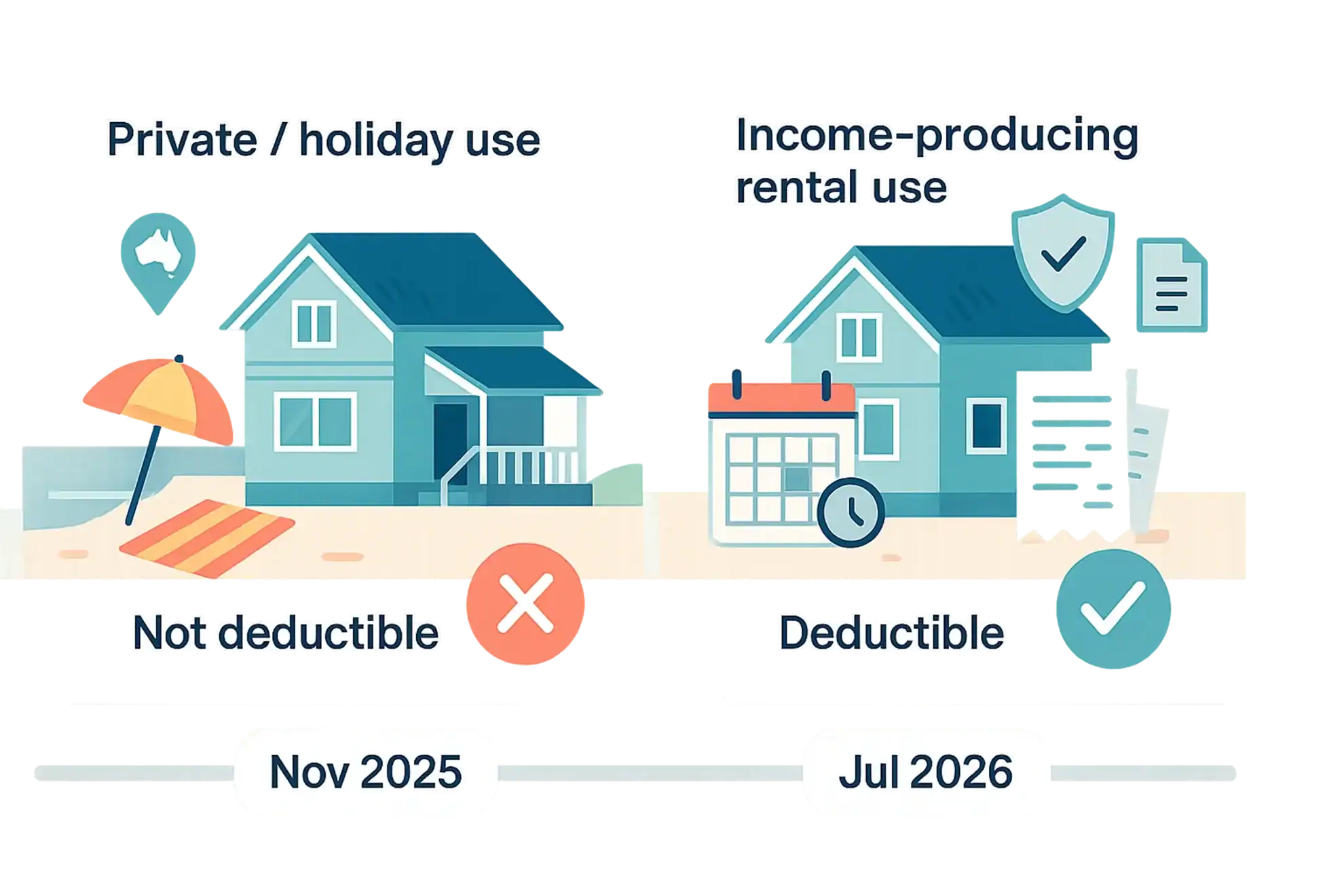

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

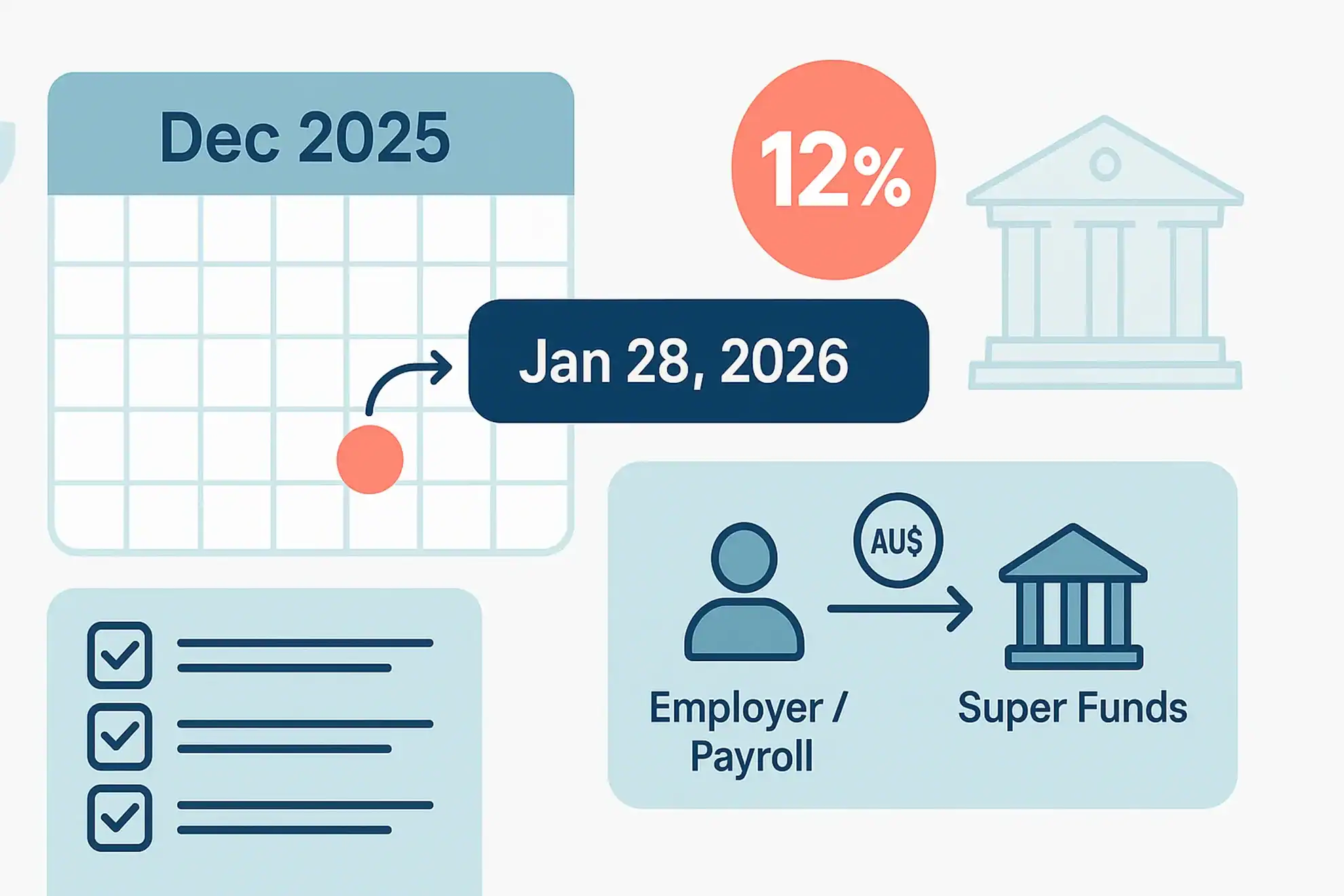

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

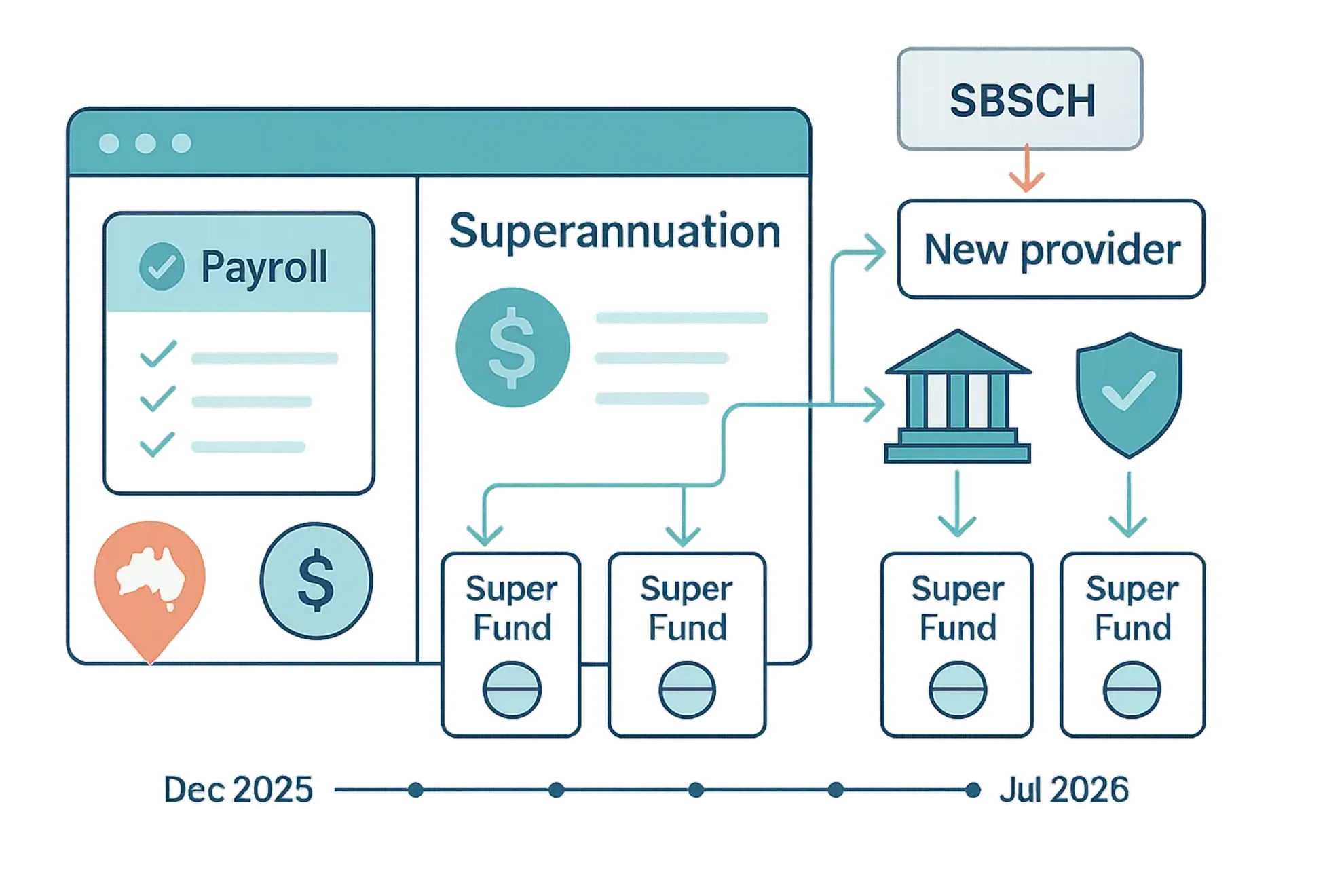

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Shopping for a luxury car? Beware of the luxury car tax.

You can judge whether a car is luxury or not, according to the government, if it costs more than $64,132 for 2016-17. It’s not an over-the-top price tag if you’re considering true luxury, but it’s enough to cop an extra tax. WHAT YOU NEED TO KNOW The luxury car tax (LCT) kicks in after that threshold […]

Extend the festive cheer (but in a tax efficient way)

The festive season is here again. As with other years it is always brimming with the spirit of giving. The list of practical ways in which Australians spread goodwill is as endless as a Christmas wreath. The ATO also gets into the spirit of the season, but of course feels required to set some limits. When […]

Christmas Party Decision Tree

This flowchart will help businesses work out the general tax implications of the year-end Christmas party. Minor benefit exemption must be less than $300 per benefit, provided on an Irregular and infrequent basis, and satisfy other relevant conditions. Income tax treatment for entertainment expenses determined under tax law. An associate of an employee is […]

The Process (and Pros and Cons) of “Electing” to be a Family Trust

Trusts are an important and very useful concept for managing one’s financial affairs, as well as estate planning. A trust is established whenever there is a separation of the legal ownership (for example, the name appearing on a land title) from the beneficial (equitable) owner of an asset (in other words, the person that a court would […]

Share Dividend Income and Franking Credits

Mum and dad investors in receipt of dividends from their share portfolio often benefit from investing in blue chip shares because they usually have franking credits attached. As a general rule, an Australian resident shareholder is assessed for tax on dividends received plus any franking credits attached to those dividends. The shareholder is assessed on […]

Where has the year gone?

Where are we going? If you decide to go on a week’s holiday you wouldn’t normally just jump in the car and take off, would you? You would need to consider many things before leaving: Where do you want to go? Where to stay? Availability of accommodation? What to take with you? How much money […]