So if you’re in the position to be able to have your cake and eat it too, there just may be icing for that cake in the form of tax advantages.

Indeed Australian Bureau of Statistics (ABS) reports indicate that home-based work is prevalent in the Australian community. The 2006 Census showed that 426,523 Australians said they worked from home, and the 2011 survey had 443,939 similarly employed. The upward trend is expected to continue, and it will be interesting to see what data comes out of the recently completed 2016 Census.

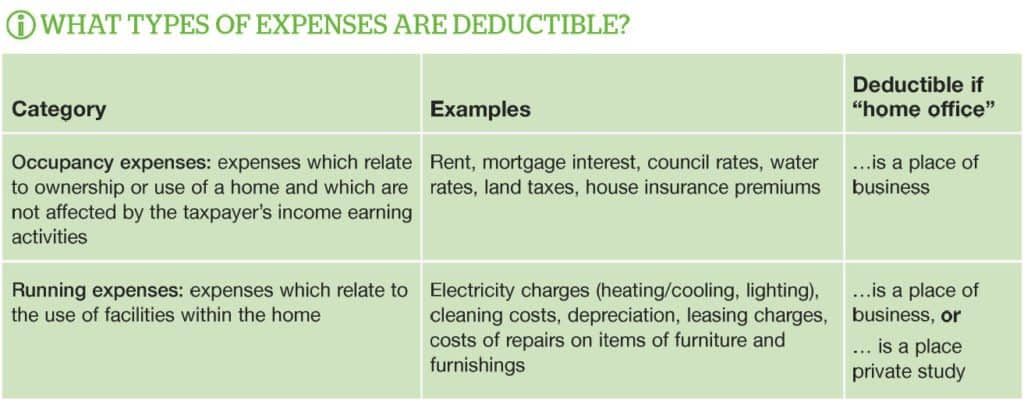

Deductible expenses that crop up from working at home are generally classified by the ATO as being either:

- “occupancy” expenses, or

- “running” expenses.

As a rule of thumb, someone operating a home business from a dedicated area of the house will be able to claim both types of expenses. Employees who do some work from home for convenience are generally only entitled to claim running expenses but not occupancy costs. Of course there are exceptions to this general rule and it depends on the person’s circumstances.

OCCUPANCY COST DEDUCTIONS

These relate to expenses for using the home, obviously, but not necessarily directly tied to the business itself. These can be rental costs, perhaps mortgage interest if you qualify, council rates or insurance premiums.

To claim a deduction for any occupancy expense, the area you set aside for working needs to have the “character of a place of business”. In other words, the room in your house that hosts “Hilda’s Hair Salon” or “Collin’s Consulting” should have the characteristics of a place that is exclusively set aside to offer the product or service that the home-based business is involved in.

Taxpayers can generally claim the same percentage of occupancy expenses as the percentage area of their home that is used to make income (for example, if the home office is 10% of the total area of the home, then you can claim 10% rent costs, council rates and so on). However opting to claim occupancy expenses, especially mortgage interest, will mean you will be expected to account for any capital gain attributable to that same business area of the home when the house is sold.

The physical size of the business area is not always the most appropriate measure. The ATO may for example also accept an apportionment based on the proportionate market value of the area used for the business compared to the rest of the property, if this differs markedly from proportionate size. The ATO will also expect you to prorate your deductions on a time basis if you use the room for private purposes for a part of the year.

NO SPECIFIC WORK AREA – NO OCCUPANCY EXPENSE DEDUCTIONS

You may still work from home but may not have a particular area set aside primarily or exclusively for these income-producing activities. Tim the teacher, for example, could be writing student reports next to the kitchen radio one day or on the front porch another day. There is no defined area from which the work is done, but Tim can still claim deductions for some utility usage such as gas or electricity (running expenses — see below). He just needs to apportion expenses and be able to show how he reached these amounts.

Then there are phone costs for business use, and even the decline in value of “plant and equipment” (chair, desk, computer) to the extent that those items were used for his income producing activities. He will however be unable to make any claims based on renting or owning the house, and also rates or insurance (that is, occupancy costs).

RUNNING EXPENSES

These can generally be viewed as those costs that directly result from using facilities in the home to help run the business, or to enable you to do a bit of work from home. These would include electricity, gas, phone bills and perhaps cleaning costs.

Running expenses may be deductible where someone with a home office can establish that they have incurred additional expenditure on the running expenses as a result of their income producing activities. Essentially, taxpayers can claim a deduction actually incurred through their income earning activities that is additional to their private expenditure (our emphasis).

BUNDLED PHONE AND INTERNET PLANS

Households commonly subscribe to “bundle” plans, giving the household access to two or more services (typically phone, internet, and subscription television services) from the same service provider. One periodic (usually monthly) fee is charged for the single bundle which is always lower than the sum of the fees that the taxpayer would have to pay if they subscribe to each service separately, which affects the calculation of the amount that is deductible.

It is necessary to appropriately match work-related use to particular costs. The ATO suggests that the bundle cost can be separated into different components as follows:

- an apportionment based on the supplier’s breakdown of the relative cost of the bundled components

- an apportionment based on the relative costs of the bundled components as if they were purchased separately from the same supplier, or

- if there is no breakdown available, then apportion based on information from a comparable supplier.

THE “CENTS PER HOUR” METHOD – AN EASIER WAY TO CALCULATE RUNNING EXPENSES DEDUCTIONS

The ATO offers taxpayers an administrative concession for calculating running expenses deductions. The home office deduction can be calculated at the rate of 45c per hour (from 2014-15; 34c per hour from 2010-11 to 2013-14.)

You must keep a record of number of hours worked at home, but are relieved of the burden of calculating the deductible amount for each type of running expense.

So if you’ve been diligently working away at home, whether as an employee or in your own business, call us on 08 9248 8124 about claiming all your rightful deductions.

© Content of this blog is in partnership with Taxpayers Australia